4 Major Security Challenges In Gold Loan Firms In India

Table of Contents

The gold loan market in India has seen immense growth since the last decade. Sourced from areport by KPMG, India’s gold loan market is expected to reach Rs 4,617 billion by 2022 at a five-year compounded annual growth rate of 13.4 percent. The gold loan market in India can be classified into two categories: Organised sector and unorganised sector.

The organised sector comprises of banks (private, public, small finance and co-operative) and NBFCs (non-banking finance company) that contributes nearly 35 percent of the Indian gold market. Unorganised sector includes informal players like private money lenders and pawnbrokers. Traditionally, the market was occupied by the informal players which saw a transformation with the emergence of financial institutions like NBFCs. NBFCs, specialized in gold loans, have increased their market presence consistently through investments in geographical expansion and branding.

With the expansion of organised sector at such a great pace, comes greater responsibility for the safety and security of the valuables. The CTO of one of the major gold loan companies in India, talking about security challenges & threats on gold loan businesses to CIO review stated “In the current business model, due to the necessity of having to open the lockers frequently, the keys to the lockers are held with branch staff who operate within a vicinity of five meters from the locker during working hours. For obvious reasons, this is a major security risk.’’

4 Major Security Challenges Faced By Gold Loan Firms In India

Earlier this year, another major gold loan provider suffered a loss of INR 12 crore due to robbery at one of its regional branches. Reported by the Hindustan Times, a group of five armed men made off with 30 kg of gold ornaments from a branch in Ludhiana.

According to a police official, the gold loan company had not employed any armed security guard and its security alarm system was not up to the mark. The absence of proactive security systems and procedures can lead gold loan companies towards unwanted loss and tainted brand reputation. Some of the major security challenges that these gold loan providers have to face are:

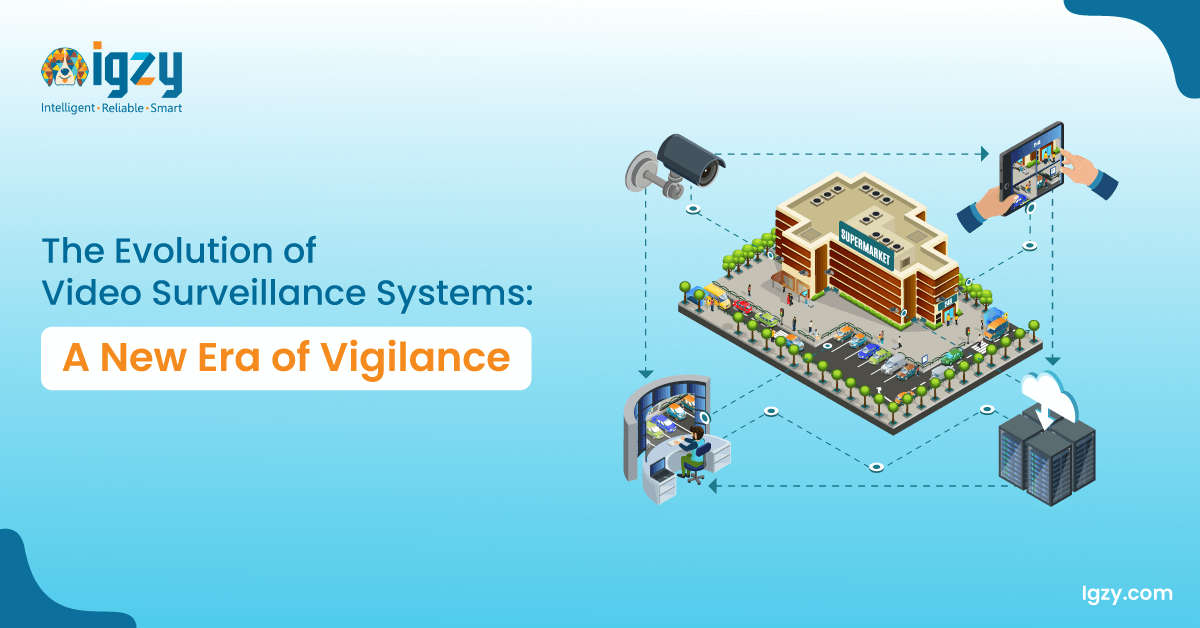

1. Unmonitored branches

The inability to view multiple branches simultaneously can keep security heads in dark of any suspicious activity taking place at one of the branches and is counted as a major reason that security teams are unable to detect robberies in real-time.

2. Lack of footage

The monitoring videos create no benefit if they are not available at the required time. The absence of a cloud platform to store video footage is a challenge faced by gold loan companies in India. The lack of evidence leads to incurable loss of money.

3. Proactive notifications and alerts

Unavailability of a proactive mechanism in a gold loan company to notify escalations about a threat in real-time affects the workflow of actions that need to be taken in order to deter a crime within time.

4. Intrusion

Considering the amount of gold that is stored inside vaults, the prime concern for branch heads is preventing unauthorized access to ensure vault safety. Real-time detection of intrusion into restricted areas is a security challenge that gold loan providers usually face.

Implementation of IoT devices in Gold Loan Banks

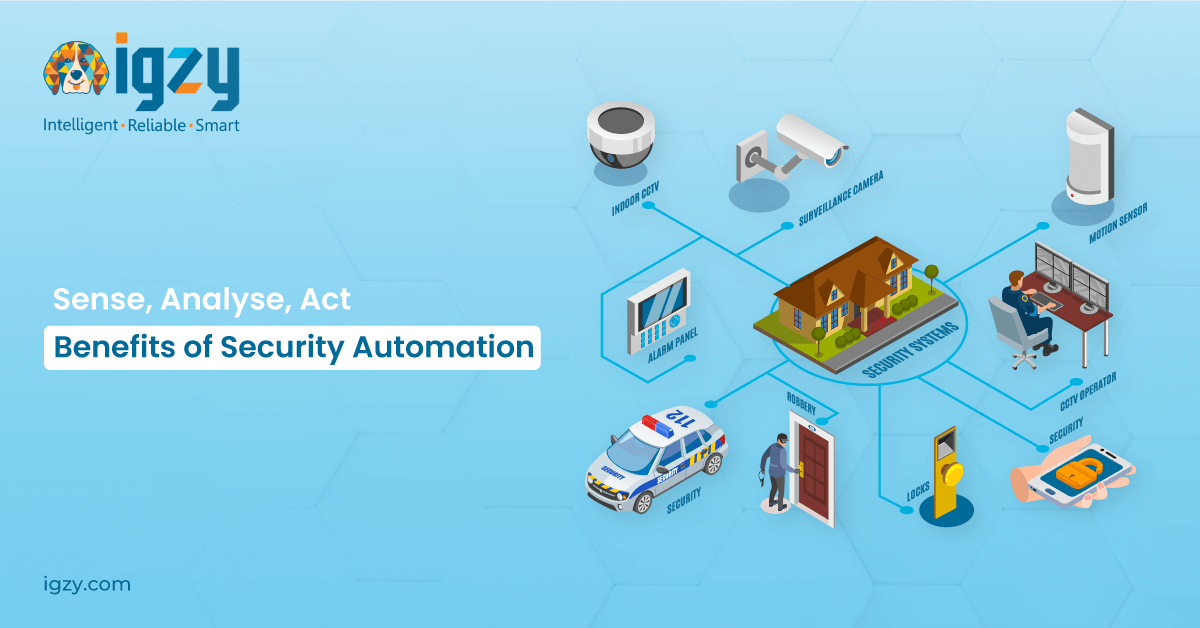

IoT solutions have been transforming the banking sector with data-driven customer insights and proactive security measures. The integration of AI and machine learning has the power to transform IoT solutions and make business operations smarter. Let us have a look at some of the potential scenarios of an IoT device backed by actionable analytics in gold loan banking:

1. AI-enabled sensors in esurveillance

With the advancement of technologies, gold loan companies can benefit from the transformation of static surveillance cameras into actionable devices. Video surveillance cameras embedded with AI-backed sensors can sense heat, vibration, motion, objects, and line crossing. It raises an alert if the sensor gets triggered and transfers a real-time notification to the command center with a snapshot from the camera.

2. Vault safety with intrusion detection

Vaults are one of the vital components of a gold loan firm. Banks can ensure total security around the vaults through the intrusion detection. Motion sensors can sense sensitive motion, creating an alert if someone tries to breach the security line. It alongside sends a notification to the platform to update command center about the intrusion.

3. Centralized command center

A gold loan finance company, being vulnerable to intrusions and thefts, if backed by a 24*7 vigilant command center responsible for monitoring every camera and responding to alerts. It verifies an incident, communicates with the intruder through two-way audio, and informs local authorities to avoid loss of valuables.

4. Footage retrieval

Video retention and retrieval becomes easy with a cloud platform for video storage. In case of a disputed incident, banks can easily find and retrieve footage stored on the cloud through date, time, and location. It benefits in the verification process of the incident and poses as critical evidence for firms to avoid any unwanted loss.

5. Actionable insights

With monitoring footfall management through surveillance cameras to balance staff and customer ratio, adherence to SOPs by the staff, and useful insights into customer behavior to provide a better experience and service, AI-driven actionable insights help gold loan providers improve business efficiency.

Gold loan in India is a major national market being majorly governed by the organized sector. The adoption of AI-backed IoT solutions can surely help them grow bigger by enhancing security, decision-making, customer services, and overcoming major security challenges.