How Is Next-Gen Bank Video Surveillance Mobilising Indian Banking Giants For A Paradigm Shift?

Table of Contents

Almost a decade ago, the rapid expansion of technology per se, the Industry 4.0 wave, induced a void within various departments of diverse industries. As a consequence, the need for tech-powered solutions became resounding. A prominent example is surveillance.

From relying on man-guarding to man-guarding supplemented by CCTV-based surveillance, vigilance evolved. Now, with the emergence of cloud-based video surveillance, experts believe that the traditional approach to security will be disrupted. The fact that banking giants across the globe are increasingly adopting this technology is solid proof of this shift.

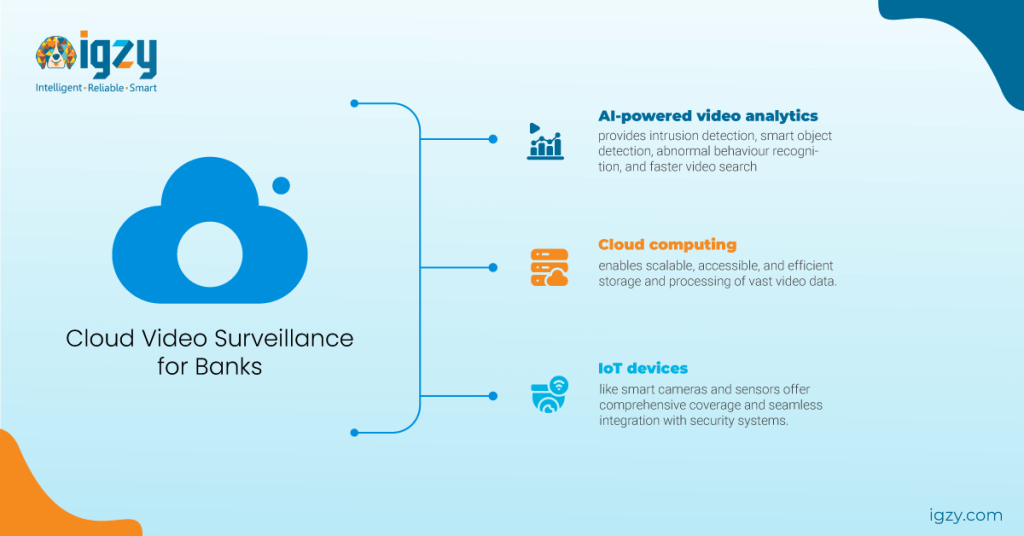

And this transformation is just the beginning. Given the increasing penetration of bank video surveillance, surveillance companies are pushing boundaries further by integrating AI, IoT, and cloud computing innovations to build super-intelligent security systems. These cutting-edge developments promise to redefine banking security, providing unprecedented protection for critical assets.

What Are Driving Forces Behind This Shift To Next-gen Bank Video Surveillance Systems?

The correlation between cash and theft is well-documented. Internal thefts remain a significant concern within the banking sector to date. A recent report states, “Internal frauds account for substantial financial losses globally.” A few years ago, a leading Indian bank faced a vault custodian theft where ~USD 4.3 million from the currency chest was swept. While the police recovered a substantial amount of the looted fund, the investigation revealed problems with the bank’s CCTV system. The hard disks containing CCTV footage were missing, and footage from recent days was deliberately deleted.

Besides this, the strict regulatory guidelines issued by regulatory authorities further emphasise the importance of video surveillance in banks. These include mandates for the placement of CCTV cameras at entry and exit points, as well as in vault rooms, and a requirement for 180-day footage storage compliance. A recent security audit by the RBI identified five cooperative banks for contravening numerous regulatory norms and fined them ~INR 60 Lacs, damaging the banks’ reputation.

Given these security challenges in banks, establishing a future-proof security infrastructure that integrates advanced surveillance technologies for proactive threat mitigation and regulatory compliance has become imperative. This positions the banking sector to adopt cutting-edge solutions and usher in India’s next-generation bank video surveillance era.

What Is Bank Video Surveillance?

Bank video surveillance uses advanced monitoring systems to safeguard assets, personnel, and customers within banking environments. These systems use cameras, sensors, and smart analytics to monitor activities, spot potential threats, and meet regulatory standards.

By leveraging this technology, banks can enhance security, ensure compliance, and create a safer environment for everyone involved. The term “Next-Gen” in bank video surveillance encapsulates a transformative approach towards security, including:

- E-surveillance solutions featuring intelligent video analytics, cloud-based storage, and remote access offer real-time monitoring with automated alerts. These alerts can be linked to various security systems, including intrusion, motion detection, perimeter breach, and tamper alarms.

- Cloud Video Surveillance with IP Cameras leverages high-resolution video feeds and remote access capabilities through Internet Protocol (IP) technology. These cameras digitise video signals and transmit them over an IP network, allowing banks to store footage directly in the cloud. IP cameras encrypt data for secure transmission and storage, providing robust backup and enabling authorised access to critical data from any location with internet connectivity.

- Advanced Video Analytics use AI and machine learning to analyse video feeds in real-time, helping banks identify suspicious behaviour and potential threats before they escalate. Features such as facial recognition, motion detection, and behavioural analysis enhance security by proactively addressing issues. These analytics also offer valuable insights into customer behaviour, which banks can use to improve service and operational efficiency.

How Do Banks Use Video Surveillance?

- Monitor ATM Areas: Surveillance cameras are placed near ATMs to deter and record criminal activities such as theft, card tampering, and vandalism.

- Secure Vault Rooms: High-security cameras monitor vault rooms to ensure the safety of valuable assets and detect unauthorised access attempts.

- Track Entry and Exit Points: Cameras at entry and exit points help monitor people coming in and out, ensuring that only authorised personnel enter restricted areas.

- Perimeter Security: Cameras installed around the bank’s perimeter provide a comprehensive view of its surroundings and detect potential threats from outside.

- Remote Monitoring: Advanced IP cameras and cloud-based systems enable remote monitoring, allowing banks to access live feeds from any location with internet connectivity.

- Regulatory Compliance: Bank video surveillance systems help banks comply with regulatory requirements, such as maintaining video footage for a minimum period of 180 days and ensuring proper camera placement.

- Incident Investigation: Recorded footage makes investigations easier, offering clear evidence to resolve disputes and assist law enforcement.

- Employee Monitoring: Bank video surveillance helps ensure that employees adhere to security protocols and perform their duties responsibly, reducing the risk of internal theft or misconduct.

From ~100% Regulatory Compliance to Deterring Security Incidents, Video Surveillance Redefines Banking Security

In the evolving landscape of banking security, IGZY stands at the forefront of innovation. IGZY addressed critical security challenges for a leading private bank in India by deploying e-surveillance solutions across its 650 branches.

This initiative significantly enhanced the bank’s security framework, reducing dependence on manned guarding, effectively mitigating security incidents and achieving 100% security compliance.

The glimpse of the challenges the bank was facing

1. Non-compliance with regulatory laws

The bank needed help to meet the stringent regulatory surveillance guidelines issued by the Reserve Bank of India (RBI). These guidelines included placing security cameras in the entry, exit and vault rooms.

2. Challenges monitoring bank and ATM premises

Rising incidents of theft and vandalism, especially during non-operational hours, given that the bank was unnotified during equipment downtime.

3. There was no single unified dashboard to manage live camera feeds from numerous branches

Managing live feeds from multiple branches simultaneously became challenging. A fragmented view led to gaps in monitoring.

4. Hardware downtime was a critical issue for the bank

Frequent hardware failures and equipment downtime hampered surveillance, leaving security gaps.

5. None or irregular device health check

Irregular device health checks led to undetected malfunctions and prolonged non-functional periods.

Strategic measures implemented by IGZY

1. ~100% regulatory compliance

Per RBI guidelines, placing security cameras at the entry, exit, and vault rooms helped IGZY achieve complete regulatory compliance and security.

2. Alert-based monitoring for swift threat detection and response

Proactive threat detection with IP cameras, night vision cameras, and sensors during and after operational hours, along with 2-way audio and panic button integration, facilitated immediate action during emergencies.

3. Equipment downtime was reduced to null with the IGZY unified AIoT-enabled dashboard

The unified dashboard streamlined the management of live camera feeds and every surveillance equipment from multiple branches, providing centralised oversight and reduced downtime.

4. Remote troubleshooting of hardware to minimise downtime

This solution ensured continuous surveillance operations across all branches via remote troubleshooting.

5. Regular device health checks via command centre

Proactive monitoring and regular health checks ensured all surveillance devices were consistently operational, effectively reducing security risks and maintaining robust system reliability.

With over a decade of experience empowering leading BFSI giants, IGZY is renowned for delivering state-of-the-art video surveillance solutions tailored for banks, retail sectors, warehouses, and more.

Our comprehensive solutions include advanced e-surveillance and cloud-based video surveillance systems that ensure compliance, enhance security, and streamline operations.

By integrating innovative technologies such as AI and IoT, IGZY provides proactive threat detection, remote troubleshooting, and continuous device health monitoring, significantly reducing security incidents and operational downtimes.

Contact our bank video surveillance experts today to learn how IGZY can transform your security infrastructure and achieve unparalleled security compliance. We also offer a complimentary initial consultation as a token of appreciation for considering our services. Reach out to us at [email protected] to get started.