10 Must-Have Bank Surveillance System Features

Table of Contents

Bank & ATM Surveillance Systems hold large amounts of cash, which often makes them a target for robberies and thefts. Despite having basic CCTV cameras and manual guards, bank ATMs still fall prey to such crimes. The financial year 2019-2020 saw over a thousand ATM-related thefts which led to a loss of over 54 crores. In this blog, we will try to highlight security challenges faced by banks and the need for a comprehensive bank security system.

Table of contents

- Security challenges faced by Banks & ATMs Surveillance Systems

- 10 Must-have bank surveillance system features

- 1. Reliable 24*7 recording

- 2. Night vision

- 3. Real-time notifications via SMS, email & mobile app

- 4. Cloud-based physical security management

- 5. Integrated bank video surveillance & access control

- 6. Easy to manage security software platform

- 7. Remote access via mobile app & web browser

- 8. Advanced filters for easy video retrieval

- 9. Data security during transmission & storage

- 10. Smart vault security with OTP-based locks

- Resolving bank security Challenges with IGZY’s bank surveillance system

- Final Takeaway

Security challenges faced by Banks & ATMs Surveillance Systems

1. Intrusions

Intrusions are wrongful entry onto the property and often come before cases of thefts and robberies. The bank surveillance systems must alert the moment a person breaks into a place with malicious intent.

2. Theft

Thefts are the security challenges that lead to the most losses for banks. It is important to equip the proper ATM security cameras and a security system that is able to actively deter such threats.

Recently, a man in Haryana was arrested in connection to a theft of 48 Lakhs from various State Bank ATMs in Tamil Nadu. As many as 14 such cases took place in the city in a matter of a few days.

3. Vandalism

Vandalism is prevalent across the country and might not lead to a direct loss of money, however, it leads to significant costs of repair and replacement. A case of vandalism might also lead to business interruption when an ATM is unable to operate.

4. Pilferage

Small incidents of theft orchestrated by staff members of the bank is one of the leading causes for tainted reputation & losses.

Other than these cases of aggression, other security challenges in Banks and ATMs may range from employee accidents, misconduct, over energy consumption, fire hazards etc. All of these cases require due attention to ensure that a banking facility can operate without a hiccup.

Taking note of all the common security challenges a financial institute may face, let us consider some must have features to ensure bank security.

10 Must-have bank surveillance system features

1. Reliable 24*7 recording

Most ATMs operate on a 24*7 clock, thus requiring day & night monitoring. They can be faced with a threat at any point during this time, therefore it is critical you have a smart banking security solution that is reliable enough to function continuously without interruptions. The cameras installed outside the ATMs should be capable of capturing clear images through the night & in the glaring sun.

2. Night vision

As we discussed, ATMs function day and night and need to be secured especially during night-time as most ATMs and banks are unattended physically during the night. Even when guarded, the number of personnel on site and their resources can prove to be futile in the face of a robbery.

Night vision enables smart IP cameras to monitor equally well during the night as in the day, which makes them a must-have in your bank’s surveillance system.

3. Real-time notifications via SMS, email & mobile app

ATMs and bank robberies don’t last very long and by the time relevant authorities are alerted, it is too late to react. Therefore, you need ATM security cameras and sensors capable of proactive alerts. These ATM e-surveillance systems can detect threats immediately and notify the authorities for a quick response which helps cut down on losses.

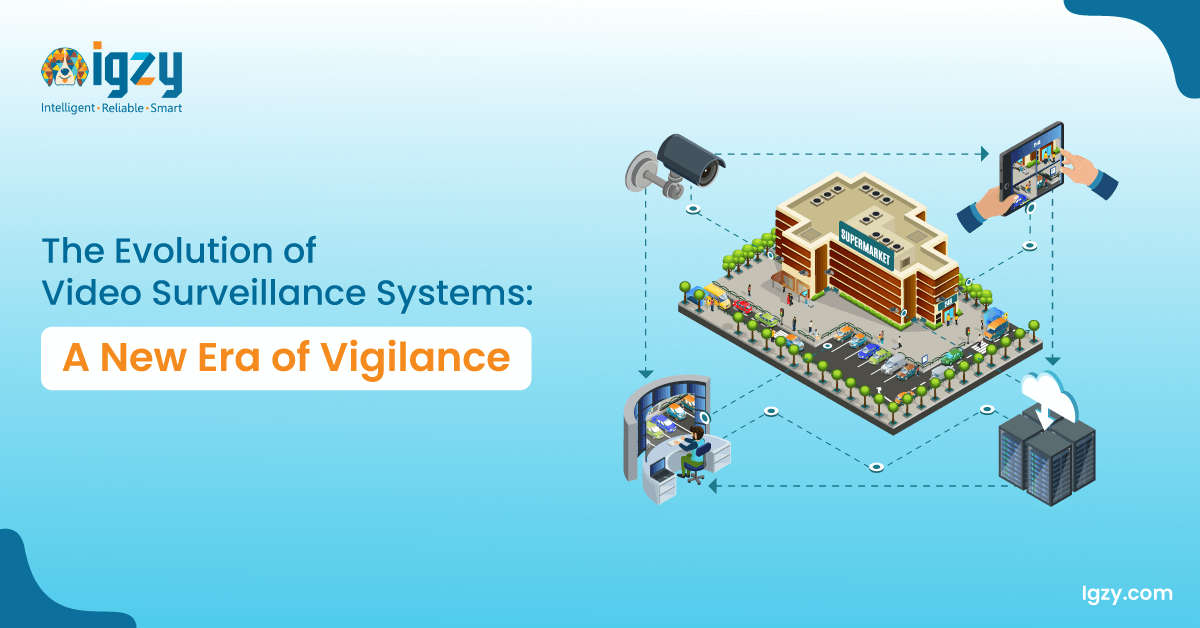

4. Cloud-based physical security management

Cloud based video surveillance enables you to store video footage and data directly to the cloud instead of storing the data locally, protecting it from being overwritten, manipulated, stolen or destroyed in a hazard like fire outbreaks.

During a break-in, for instance, an assailant has access to your local storage and can destroy all video recordings of the robbery. However with cloud-based bank video surveillance, all your recordings are safe from such threats.

5. Integrated bank video surveillance & access control

The bank’s video surveillance system must be integrated in the sense that all security devices can work together, supporting each other and sending data to a common platform.

For example, if the bank access control system suggests forced entry on a particular door, a nearby camera monitoring that area can be used to verify the threat.

6. Easy to manage security software platform

It is critical for a bank’s surveillance system software to be easy to manage. This is because the platform will be accessed by executives who will want to go through data from multiple devices over dozens of sites. It is critical that they are able to navigate through the platform on their own.

7. Remote access via mobile app & web browser

As discussed earlier, most ATMs function all day long and are prone to attacks at any time of the day. Moreover, ATMs are spread over several locations over a wide geographical area, which means it is hard to monitor them individually. Therefore, remote control of the site is necessary to give you access to any site from wherever and whenever you want.

8. Advanced filters for easy video retrieval

It’s a tedious task to go looking for a particular recording from all your data. A smart bank surveillance system allows you to set filters like date, time, and location to easily fetch a recording. This allows you to access any recording whenever you please without having to go through the IT team saving both time & effort.

9. Data security during transmission & storage

Traditional CCTV cameras using lines can easily be tapped into, giving anyone access to all your recordings leading to a breach in security. IP cloud storage cameras on the other hand run simple encryption on your recording which makes them useless to anybody without the encryption key. This means all your data in wires and storage devices are safe and cannot be viewed by any unauthorized person.

10. Smart vault security with OTP-based locks

Bank vaults and currency chests hold large sums of money and their protection is the top priority for a bank. A smart bank surveillance system can help fortify the security at such sites.

An OTP-based lock can be used to open the vaults with only the command centre having the authority to generate this OTP. The bank manager can request the command center for the OTP every time they need access to the vault.

The command center can use the CCTV camera stream to verify the bank manager is not being forced and the bank is not under any distress. Once verified they can give access to the vault. They can then monitor the situation till the work with the vault is done and the gate is locked again.

Resolving bank security Challenges with IGZY’s bank surveillance system

IGZY provides a holistic bank video surveillance solution for all the safety and security needs of your Banks and ATMs.

Our IoT banking security solution includes all the key features and functionalities mentioned throughout the blog to bring to you the most complete and comprehensive bank security system in the market.

Our client’s needs and safety are our top priority, which leads us to employ security experts who carefully evaluate your sites, understand your needs, and then design a solution that will suit you best.

Most importantly, IGZY’s solutions provide end-to-end security, which means we take of each and everything from initial setup and installation to routine maintenance and repairs.

Final Takeaway

Some things you must take away from the blog about the must-have features of a bank surveillance system are:

- Cloud platform to safely store and access your recordings is a must.

- Remote access and easy video retrieval are critical things when looking at a surveillance system.

- Active alert capable system to aid quick reaction and cut down on losses.

- An integrated platform where you can monitor all your devices at once.